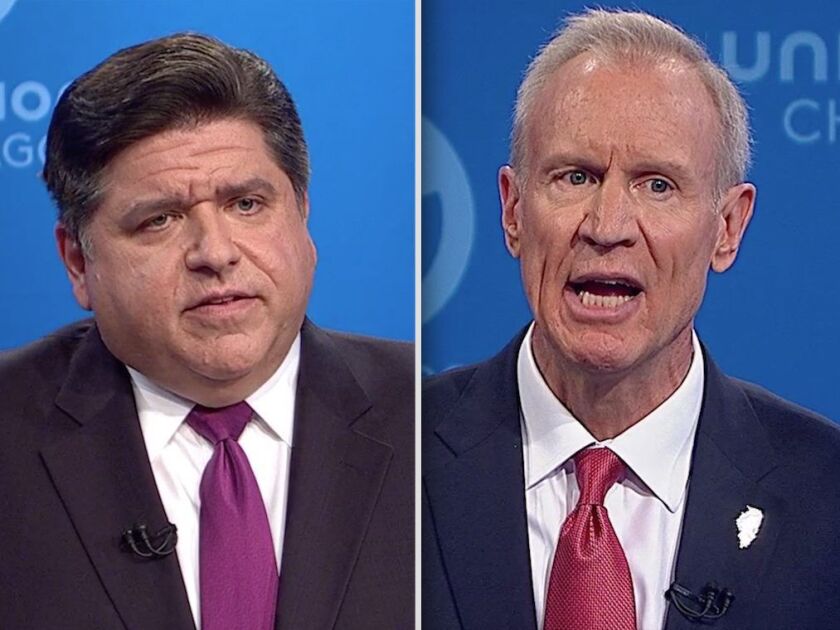

Republican Gov. Bruce Rauner has run numerous re-election ads attempting to tie Democratic rival J.B. Pritzker to high taxes, public corruption and powerful state House Speaker Michael Madigan. In Rauner’s telling, Madigan is the ultimate puppet master of Illinois politics, controlling Pritzker and everyone and everything the governor deems bad.

Now Rauner has yet another ad that not only hits the same themes but dispenses with all subtlety by using actual puppets to deliver his points.

“For decades, Madigan kept property taxes high and made a fortune helping cronies like Pritzker dodge them,” the talking puppets claim as they ask viewers to take it from them that Madigan is pulling Pritzker’s strings.

Madigan, a Chicago Democrat who has served as speaker for all but two of the past 35 years, undeniably wields considerable power.

On the side, he also is a partner in a law firm that, like many others, does lucrative work contesting appraisals for commercial and industrial property to secure real-estate tax reductions for clients. So the ad’s reference to the money he’s made in the field is clear.

But property tax levies are set at the local level, not by lawmakers in Springfield. That makes the main beat of Rauner’s contention a head scratcher.

How could Madigan, as a state lawmaker, take action to ensure local property taxes remain high? And what about his work suggests his clients are “cronies” out to game the system?

A property tax primer

Understanding the thrust of the ad’s claim requires a brief journey into the weeds of property taxes in Illinois.

The state itself stopped taxing property a decade before the 76-year-old Madigan was born.

Since then, the taxing of property has been largely a local affair, with municipal and county officials determining assessments, tax rates and levies. The state isn’t totally divorced from the process, however.

During Madigan’s lengthy tenure as speaker, lawmakers and the governor imposed a cap on how much most local governments in the state could raise property tax levies each year. Last decade, Springfield responded to soaring home values in Cook County by temporarily imposing limits on the growth of assessments for tax purposes.

Despite that history, Justin Giorgio, a Rauner campaign spokesman, said Madigan had “consistently” opposed legislation that would prevent local officials from increasing their levies. During a two-year state budget standoff between Rauner and Madigan, both backed property tax freeze plans, though the speaker’s was not as sweeping. Neither plan became law.

But the biggest impact the state has on the size of property tax bills is what it doesn’t do. Few states chip in as little to cover school costs as does Illinois, forcing school districts to rely on local revenue to cover more than 60 percent of education costs.

“In just about every other state in the union, the state itself puts more into local public schools than we do in Illinois,” said Charles N. Wheeler III, a state budget expert and director of the Public Affairs Reporting program at the University of Illinois-Springfield.

That practice has been reinforced for decades by the spending policies set by state Republicans and Democrats alike, despite a goal laid out in the Illinois Constitution for the state to assume “primary responsibility” for funding K-12 schools.

Two decades ago, then-Gov. Jim Edgar, a Republican, pushed to change that. He proposed a “tax swap” that would increase the state income tax, using the extra funds to support schools and provide property tax relief.

That plan passed Madigan’s chamber with the speaker’s support but was spiked in the Senate by members of Edgar’s own party.

Commonplace practice

The ad also accuses Madigan of capitalizing on high property taxes to line his pockets by helping “cronies like Pritzker” avoid them.

Madigan has been elusive about his personal wealth, but he once said he makes at least $1 million “in a good year.” And in 2015, his practice ranked second among law firms for total property tax refunds in Cook County, according to a Reuters report.

Giorgio, Rauner’s spokesman, pointed us to county records showing a lawyer from Madigan’s firm has represented a company owned by the investment group Pritzker co-founded, securing reductions in its property value assessments.

But there are tens of thousands of property assessment appeals filed in Cook County each year by a multitude of law firms, so it is unclear what makes the clients of Madigan’s firm “cronies.”

When asked, Giorgio pointed only to why the campaign pinned the term on Pritzker.

“It has been shown that Madigan’s law firm has received a large number of tax reductions from [Cook County Assessor Joseph] Berrios. Berrios is the head of the Cook County Democratic party, former Democratic State Rep. and an ally of Madigan,” Giorgio wrote in an email. “Pritzker has been a donor to Madigan and Berrios. Pritzker has received successful reductions through hiring Madigan’s law firm from Berrios. That’s clearly a ‘crony’ connection.”

That’s besides the point, however, because state lawmakers do not set property assessments.

Our ruling

A recent Rauner ad stars puppets that declare “for decades, Madigan kept property taxes high and made a fortune helping cronies like Pritzker dodge them.”

That claim suggests Madigan, the powerful House speaker, acted as a lawmaker to ensure Illinois property taxes remain some of the nation’s highest.

For support, Rauner’s campaign said Madigan has kept property taxes high by “consistently” opposing legislation to provide property tax relief, even though Madigan’s record says otherwise. The claim also ignores the reality that state lawmakers play no direct role in the assessment process, which takes place at the local level.

There is a glimmer of truth in the ad’s contention that Madigan is a partner in a law firm that conducts property tax appeals work for those who can afford it, including a Pritzker-owned company. And it’s a lucrative business because property taxes are extraordinarily high in Illinois.

But skyrocketing property taxes are part of a long and bipartisan legacy in Springfield of foisting the lion’s share of public school funding onto local property tax payers.

We rate the ad’s claim Mostly False.

The Better Government Association runs PolitiFact Illinois, the local arm of the nationally renowned, Pulitzer Prize-winning fact-checking enterprise that rates the truthfulness of statements made by governmental leaders and politicians. Ahead of the historic 2018 elections, BGA’s fact-checking service is teaming up weekly with the Sun-Times, in print and online. You can find all of the PolitiFact Illinois stories we’ve reported together here.

Sources

“Madigan’s money maker: lowering property taxes for big business,” Reuters, Feb. 8, 2017

Guide: The Illinois Property Tax System, Illinois Department of Revenue, accessed Oct. 5, 2018

Report: Property Taxes in Illinois, Commission on Government Forecasting & Accountability, April 17, 2014

“Property tax cap draws foes; Plan to limit assessments criticized as it heads to House,” Chicago Tribune, Feb. 20, 2004

Email interview: Justin Giorgio, Rauner campaign spokesman, Oct. 2 – 3, 2018

“Illinois House Democrats push tax freeze to end budget impasse,” Reuters, June 26, 2017

Report Card Library, Illinois State Board of Education, accessed Oct. 5, 2018

Phone interview: Charles N. Wheeler III, director of the Public Affairs Reporting program at the University of Illinois-Springfield, Oct. 3, 2018

Illinois State Constitution: Article X, Illinois General Assembly

“Bernard Schoenburg: Tax swap? Rauner open, but not pushing,” State Journal-Register, March 31, 2016

Press release: Pritzker Group Acquires LBP Manufacturing, Pritzker Group, July 14, 2015

Records: 2017 Property Tax Assessment, Cook County Assessor’s Office, accessed Oct. 5, 2018

“The Tax Divide: Commercial Breakdown,” Chicago Tribune, Dec. 7, 2017