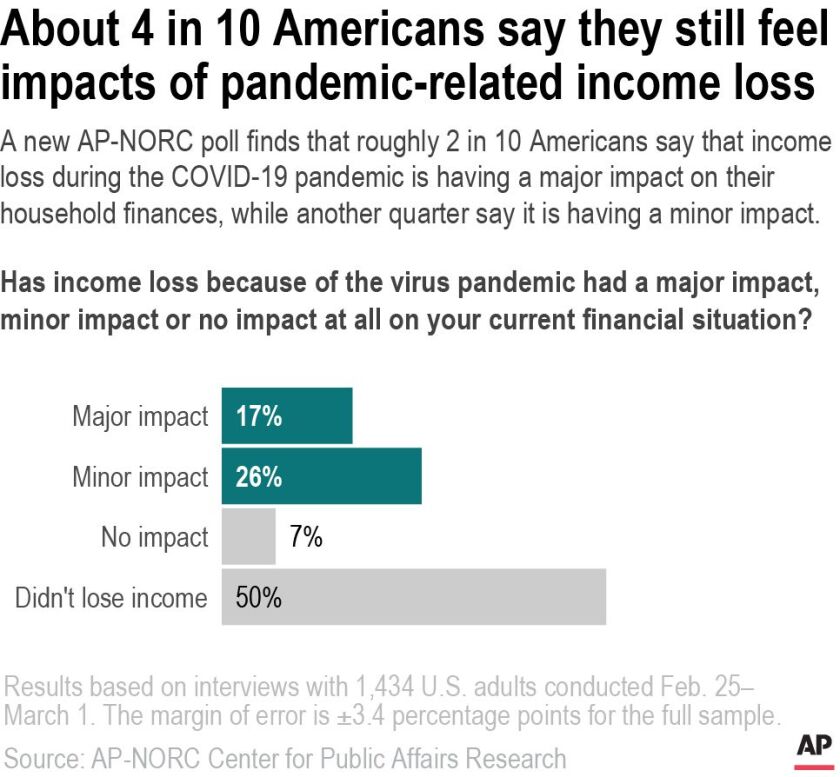

Roughly four in 10 Americans say they’re still feeling the financial impact of the loss of a job or income within their household as the economic recovery remains uneven one year into the coronavirus pandemic.

A new poll by The Associated Press-NORC Center for Public Affairs Research provides further evidence that the pandemic has been devastating for some Americans while leaving others virtually unscathed or even in better shape when it comes to their finances.

The outcome often depended on the type of job a person had and their income level before the COVID-19 pandemic.

The pandemic has particularly hurt Black and Latino households and younger Americans, some who are now going through the second major economic crisis of their adult lives.

“I just felt like we were already in a harder position, so (the pandemic) kind of threw us even more under the dirt,” says Kennard Taylor, a 20-year-old Black college student at Jackson College.

Taylor moved back in with his family after losing his job as a server at his campus cafeteria in the first weeks of the pandemic and struggling to make rent and car payments while continuing his studies.

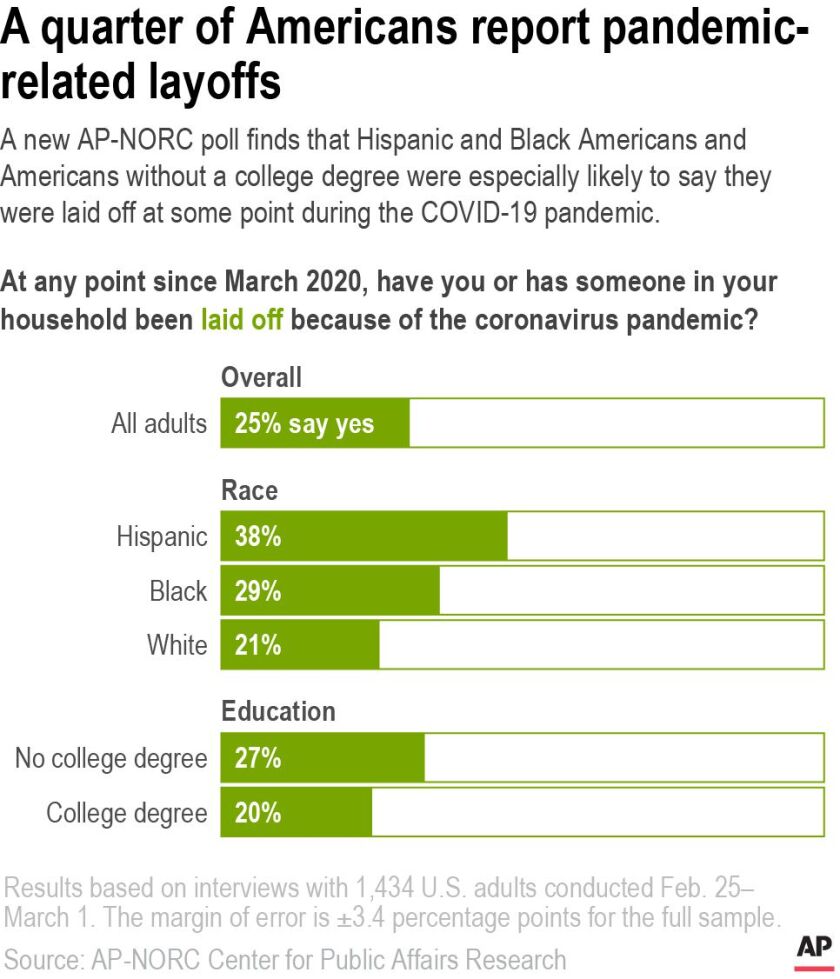

The poll found that about half of Americans say they have experienced at least one form of household income loss during the pandemic — including 25% who have experienced a household layoff and 31% who say someone in their household was scheduled for fewer hours.

Overall, 44% said their household experienced income loss from the pandemic that is still having an impact on their finances.

The poll results are consistent with recent economic data. Roughly 745,000 Americans filed for unemployment benefits the week of Feb. 22, according to the Labor Department, and roughly 18 million Americans remain on the unemployment rolls.

Thirty percent of Americans say their current household income is lower than it was when the pandemic began, 16% say it is higher, and 53% say there’s been no change.

About half of those who experienced any form of household income loss during the pandemic say their current household income is lower than it was.

The poll of 1,434 adults was conducted between Feb. 25 and March 1 using a sample drawn from NORC’s probability-based AmeriSpeak Panel, designed to be representative of the U.S. population. The margin of sampling error for all respondents is plus or minus 3.4 percentage points.

The poll’s findings reflect what some economists have called a “K-shaped recovery,” in which:

- Those with office jobs were able to transition to working from home.

- Those who worked in hard-hit industries such as entertainment, dining and travel suffered.

- The poor have struggled to recover financially compared to the wealthy.

- Black and Latino households haven’t bounced back as well as whites.

Logan DeWitt, 30, of Kansas City, Kansas, kept his job with the government through the pandemic because he could work remotely. But his wife, a childcare worker, lost her job and, after months of searching for a new one, has returned to school. Their financial situation was further complicated by the fact that their first child was born in the early months of the pandemic.

“We had plans to get a house,” DeWitt says. “Had to scrap that idea. And we consolidated down to just one car. We do a lot of cooking from home and buying in bulk.”

Based on the poll, about one in 10 Americans say they couldn’t make a housing payment in the past month because of the pandemic. And roughly as many say the same regarding a credit-card bill. Overall, about a quarter of Americans say they’ve been unable to pay one or more bills in the last month.

Thirty-eight percent of Hispanics and 29% of Black Americans have experienced a layoff in their household at some point during the past year, compared with 21% of white Americans.

This recession has been particularly hard on younger Americans. Forty percent of Americans under 30 report lower income now,compared to March 2020. About four in 10 have been scheduled for fewer hours. Roughly a quarter say they quit their job. Many millennials, who experienced the Great Recession early in their adult lives, are now experiencing yet another major financial crisis.

The timing of the Biden administration’s $1.9 trillion stimulus package that includes aid for many Americans and business still feeling the impact of the pandemic is crucial — many of the relief measures passed earlier by Congress, most notably unemployment benefits, will be coming to an end in the next few weeks.

“It’s really going to help us,” says Nikki Luman, 43, who lives in Sycamore, Ohio, and worked part-time at her local library, which shut down in the early weeks of the pandemic.

The library is still operating at low capacity due to COVID restrictions. That means fewer hours for her each week.

“That’s $400 a month that we have been missing for the past year,” she says.

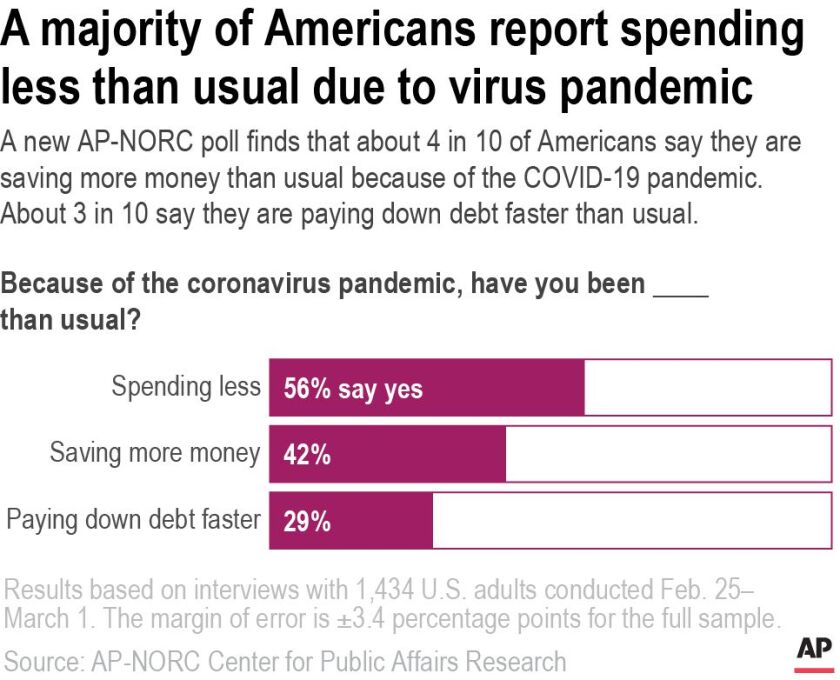

Things aren’t as dire as they were in the early stages of the pandemic for some Americans — in part because of previous measures taken by Washington. Also, changes in lifestyle — less eating out, less traveling, no live entertainment — have allowed some Americans to make their financial lives healthier. In the poll, roughly four in 10 say they’ve been saving more money than usual, and about three in 10 have been paying down debt faster than usual.

Tracie Jurgens, 44, who works in the trucking industry, says her income evaporated in the first weeks of the pandemic as demand for truckers plummeted. Jurgen’s boss was able to get a loan through the federal Paycheck Protection Program for small businesses, which he used to buy new equipment in the summer as things started to recover.

“I don’t know what I would have done if he didn’t get another truck,” she says.

Contributing: Nathan Ellgren