How often do you hear political candidates promise to spend more than $1 billion in return for — nothing?

We can’t recall ever hearing that.

But a new report out Monday says that’s exactly what Illinois has done over the past couple of years. Our state incurred more than $1 billion in interest penalties because it didn’t pay its bills on time, according to the first Debt Transparency Report from Comptroller Susana A. Mendoza.

EDITORIAL

That’s $1 billion that didn’t improve our schools. That didn’t make our transportation systems run more smoothly. That didn’t make health care better. That didn’t provide jobs training or social services. That didn’t help pay off a piece of the state’s massive pension debt.

Because Illinois went more than two years without a budget — and its revenues didn’t come close to matching expenditures — unpaid bills started to stack up in government offices around the state. By law, the interest on many of those bills was 12 percent once they went unpaid for 90 days. The law was intended to encourage bureaucrats not to sit on bills. No one anticipated a time when the state would have no budget.

Twelve percent in today’s economy is a ridiculous expense. To paraphrase the old joke, you pay 12 percent here and 12 percent there, and pretty soon it adds up to real money. In Illinois’ case, it added up to more than $1 billion.

If you piled up a billion dollar bills, the stack would be more than 67 miles high.

That’s $1 billion Illinois didn’t need to pay, or could have spent things that would have benefitted the state. You might call it a foolish-management tax.

Now that the state has an actual budget and some $5 billion more in revenues, the pile of unpaid bills has dropped from $16.7 billion to about $8.8 billion. Proceeds from a $6 billion bond sale have lowered the interest on remaining bills to 3.5 percent.

But the lower interest rate won’t bring back the $1 billion the state has already spent. It won’t revive the many small businesses in Illinois that closed because they weren’t getting paid for services they provided to the state. It won’t help people who worked at those businesses who lost their jobs.

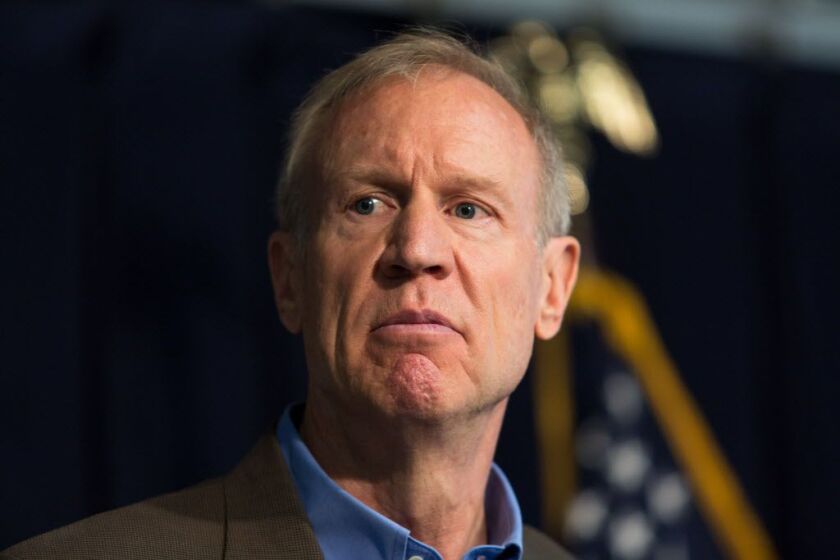

Next month, the annual budget process will start up again when Gov. Bruce Rauner

is scheduled to present his spending plan for the next fiscal year. Rauner has said it will include unspecified spending cuts.

Whatever emerges after his plan goes to the Legislature, it should include a plan for avoiding paying huge amounts of unnecessary interest in the future.

Send letters to letters@suntimes.com.